… A Telephony Market Rollup

… A Telephony Market Rollup

Sigh. Things are different and certainly interesting but they're certainly not hopeless. I strongly believe that this disappointing economy can be a great opportunity for the bold. For folks worried that Chapter 11 is the end of the world for Nortel keep in mind that every major US airline, except for American Airlines, has been in and out of Chapter 11 at least once. They can and do continue to operate pretty well in Chapter 11.

Of course Nortel is no airline but it's strategic role as a supplier to Verizon (nearly $1 billion in products and services in 2008) and other phone companies, it is not likely to be severely disrupted or sold to the Chinese for that matter, not to mention Canadian pride.

Can Nortel buy their way out of this mess?

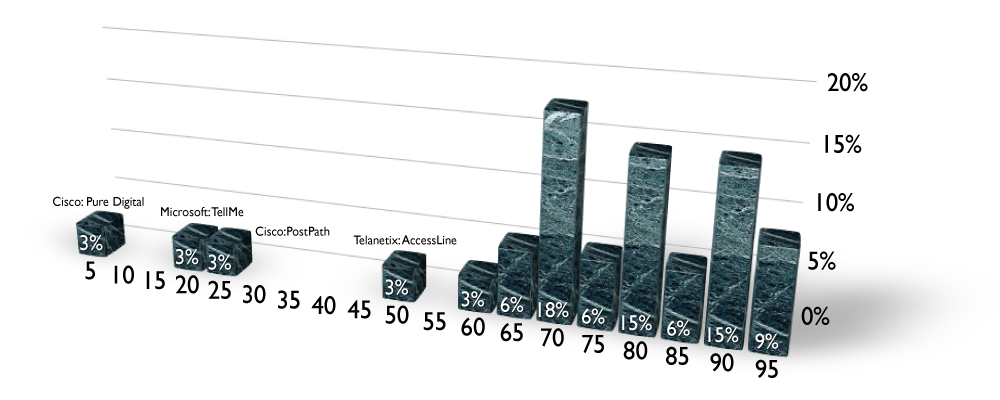

As suggested in my post of August 2008, the price of purchasing competitors and their customer base is less than the cost of winning the customers the old fashioned way. And Nortel's financial weakness is exactly the right trigger to start the ball rolling. That should be the core business plan for the Enterprise group – be the catalyst to rollup the competition and operate each to focus on serving their customers better.

As practiced by Aastra on a small scale, synergies on commodity elements (processor platform vendors, OS licensing fees and or support costs, handsets, frames, and fans) including some R&D areas leads to higher profits while serving customers with maniacal focus. This model is a case of comparative advantage across major acquired units. Each unit has their own R&D budgets supported by their stable sales and service streams. Each unit has access to each others' core technologies to address opportunities within their core business. Corporate provides a shared finance control function.

Oracle perfected this over the past decade and became one of the largest and most profitable companies around as each of its acquisitions abandoned industries and markets they really had no business doing with smooth transitions for customers at their pace. Some see this with the Borg-like mantra – resistance is futile – which, in Oracle's case was definitely the case, although it is useful to note that resistance usually leads to higher prices for shareholders.

Carrier units, on the other hand have different, but still interesting options:

- The Carrier voice business (CS 2000 – successor to DMS100, DMS250 and DMS10 platforms) should be sold to or merged with Broadsoft, who recently acquired the sick Sylantro. This could be a solid rollup allowing each participant to focus on unique market segments where they are strong – North America versus ROW, Europe versus Asia, incumbents, challengers, hosted for enterprise, mobile etc… – and SHARE sales, supply chain and support costs.

- The Metro Ethernet Networks business should be spun out to shareholders as a standalone unit if acquisition prices are not high enough. In this way they could position their (new) balance sheet as the strongest of the strong and go acquire their competition in the North American market. When Cisco was shutout of the cable TV market or in risk of being shutout, they went and acquired Scientific America to be sure that Cisco was engaged in that industry's strategy discussions…Maybe, MEN should do the same for the fiber-telco/fiber-cableco market. Is this the time to acquire Arris or be acquired by for example, with whom Nortel has had strategic relations with for many years? Note: $1 billion is a 25% premium to current market cap (1.15.09). If that's too pricy, how about BigBand Networks where $500 million is a 50% premium to current market cap (1.15.09)? The MEN space has the greatest potential for product and customer-facing synergies.

- The wireless unit which lives to serve CDMA players primarily in USA and Canada has Verizon Wireless, Bell Mobility, Sprint and Telus as their top customers. Shouldn't this be an attractive business for Nokia-Siemens which would love to have these customers? How about Motorola too?

The carrier market unit has not kept pace with the fundamental factors for growth. They have missed most of the major trends in the carrier market, instead having a sales organization focused on selling more of the same classes of infrastructures to the same purchasing organizations. DMS was truly a great product with exactly the right architecture at the time, but today, it's too much or too little for what carriers need to have done, as startups have shown Nortel and Alcatel-Lucent time and again.

Merging with a European telecom vendor may have spared some pain, since the market proclivity for shared central telecom infrastructures is higher there as opposed to the North American penchant for enterprise ownership of all but the most trivial of communications transport. But it may only have delayed the inevitable as we'll see what happens with Alcatel-Lucent in the coming months.