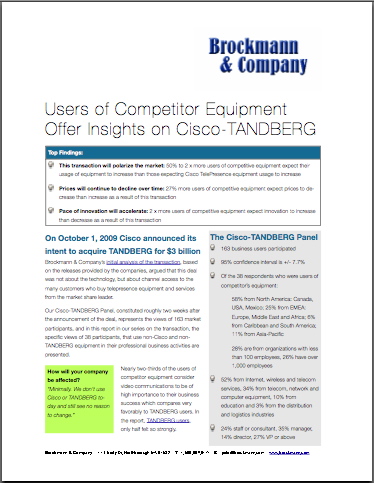

The acquisition of TANDBERG by Cisco, announced October 1, 2009 is not one of the typical deals that made Cisco what it is today since they plan to acquire a large, existing business complete with its own channels that would complement the Cisco direct sales organization currently responsible for selling and servicing Cisco TelePresence equipment.

Shortly after the announcement, Brockmann & Company convened a panel from our pool of 25,000 business users of communications products and captured the perspectives of 163 users, resellers and competitors. This is the second in a series on the perspectives of the key participants (witting or unwitting) in the transaction and discusses their views of the implications for the industry. (This is the first in the series).

We discuss the user-of-competitors-equipment expectations on pricing, competitiveness, innovation and interoperability and their views on how product and service consumption will be affected. Comments from survey participants are also presented anonymously. Interestingly, respondents in this report did not set such high expectations on interoperability as respondents in the first report in the series. As well, this segment of our panel expected prices to decline, moreso than TANDBERG users.