Now that’s how you hold a bankruptcy court supervised auction. Package up the business, get a stalking horse bid (Nokia Siemens Networks bid $0.65 billion last month) and then supervise bidding that doubles the stalking horse bid. Ericsson picks up major market share in the North American wireless market (Nortel CDMA customers include Verizon Wireless (Nortel’s largest customer), Sprint, Bell Mobility and Telus in Canada), a market that they avoided by not having any CDMA solutions.

Now that’s how you hold a bankruptcy court supervised auction. Package up the business, get a stalking horse bid (Nokia Siemens Networks bid $0.65 billion last month) and then supervise bidding that doubles the stalking horse bid. Ericsson picks up major market share in the North American wireless market (Nortel CDMA customers include Verizon Wireless (Nortel’s largest customer), Sprint, Bell Mobility and Telus in Canada), a market that they avoided by not having any CDMA solutions.

BTW, Alcatel-Lucent has the other half of the CDMA market place. No doubt US and Canadian anti-trust advisors told them not to bother to bid.

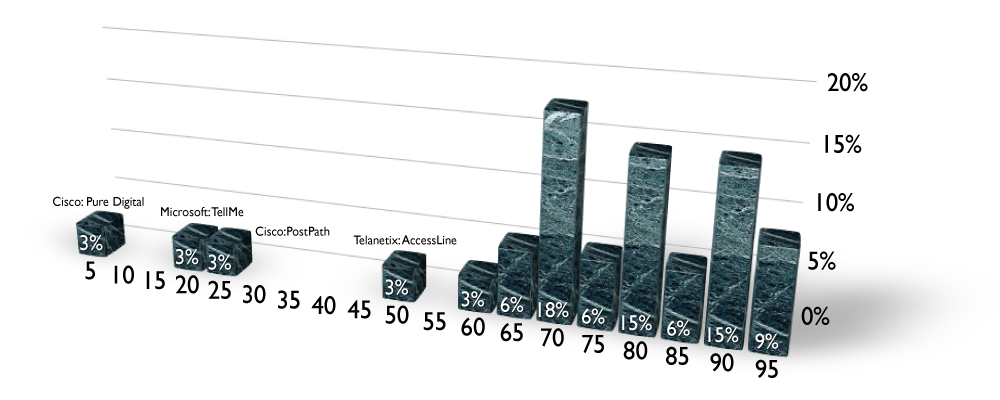

CDMA is a competing radio technology used primarily in Canada, US and South Korea, while the rest of the world uses GSM. It is optimized for a voice-only network, is still in production and expected to have a 10-year or more life cycle but will be replaced with higher speed 4G technology such as LTE (Long Term Evolution). This unit of Nortel is debt free and comes with a patent licensing portfolio for LTE, that could generate $2.7 billion in licensing fees from handset manufacturers (Qualcom showed how to do this with its CDMA patent portfolio, which is one of the reasons why Nokia is not that big in the US market since they avoided settling a dispute over licensing with Qualcom and therefore can only address about 60% of the US market). See Bloomberg: some thought NSN should have paid more to keep this out of the market leader’s hands.

Was it worth more than $1.13 billion? Probably. But timing is everything.

It’s the lifecycle.

Since its founding in 1991 by John Roth, Nortel Wireless has always been a drain on profits and rarely profitable. Now, it is largely in sustain mode and apparently quite profitable, with limited R&D spending, next to no marketing expenses (all the carrier decisions have already been made) and large, well known customers with no easy substitutes. Yum. The goal now has to be to milk it – raise prices but not so high so customers accelerate their replacement spending and cut non-customer-facing costs.

RIM wanted to participate, wrapping their participation in the Canadian flag. Jim Balsilie, rebuffed on his NHL-team-in-Hamilton proposal, was probably relishing the notion of extracting licensing payments from its handset competitors but complained that they’d be prohibited from bidding on other Nortel assets and so declined to participate.

Here’s the Brockmann analysis on this deal:

Strategic Fit [5/5].

One big wireless equipment company (Ericsson is the largest) buys another big wireless equipment company effectively doubling their employees in and revenues from North America. Given the complementarity of the CDMA-GSM businesses, Ericsson is the leader in GSM networks, this is a very strong strategic fit. This deal could have made for a very very interesting evolution in the market if Huawei had purchased Nortel, but that would never have passed US or Canadian national security muster.

Timing [5/5].

Recessions are extraordinary times for the strong to get stronger. Nortel’s ungraceful fall into chapter 11 and inability to extract itself from the ooze of the process is what is supposed to happen – industries and the companies in them restructure themselves to become stronger in the economy recovery. In this way we are setting the stage for future growth.

Ericsson has been a bottom-feeding fish. In recent years, they picked up Marconi, Redback and Tandberg TV. In many ways, this deal is similar in that the business comes with customers that denied Ericsson earlier and few others are interested.

Customer Demand [4/5].

Nortel wireless customers are between a rock and a hard place for the next five years or so. They need to maintain their CDMA networks in an excellent state of operational execution so as to maximize their revenues while they invest billions in new network technologies that will eventually replace the aging infrastructures. This is a time that most high tech marketers and business people don’t like being in – it’s no longer about the future. It’s now about reality of today. So, for some this is a boring business. The whipper-snappers complain that there’s no sizzle here and the accountants work to cut spending on the fun and interesting things like big tradeshow booths, slick new R&D and the like. There’s simply no need.

Customers have needs, can’t really substitute for another quite so fast and vendors can implement practices that ‘manage’ the revenues. While it’s boring, it’s also extremely profitable and important to have excellent customer relations.

Potential [4/5].

Clearly this is a good deal for Ericsson. This will pay for itself within a year and fills a gap in their market coverage model. Some argue that their recent deal to manage the network operations for Sprint could lead to Nortel CDMA equipment sales, but Nortel had a 50-50 chance of winning any of those anyways since there is only one other contender for CDMA infrastructures.

As bright a spot Nortel’s early development in LTE is, LTE is a long ways away and there will be billions of R&D dollars required to turn the PowerPoints and patent applications into real product and real business. That enormous capital and executive stamina is what Nortel Wireless does not have on its own. Of course, there will be no out-and-out winners in the telecom equipment market anymore (as if there ever was). This will be a slugfest of giants where being a small part of something big will be plenty rewarding (instead of a big part of something small).