IBM announced today that it had signed a Memorandum of Understanding with ILOG , a French publicly traded software manufacturer for [[Service-Oriented Architecture]] (SOA)-based Business Rules Management. IBM is ILOG's biggest partner (among the prestigious group of Microsoft, Oracle, Fujitsu, EMC, SAP and others).

IBM announced today that it had signed a Memorandum of Understanding with ILOG , a French publicly traded software manufacturer for [[Service-Oriented Architecture]] (SOA)-based Business Rules Management. IBM is ILOG's biggest partner (among the prestigious group of Microsoft, Oracle, Fujitsu, EMC, SAP and others).

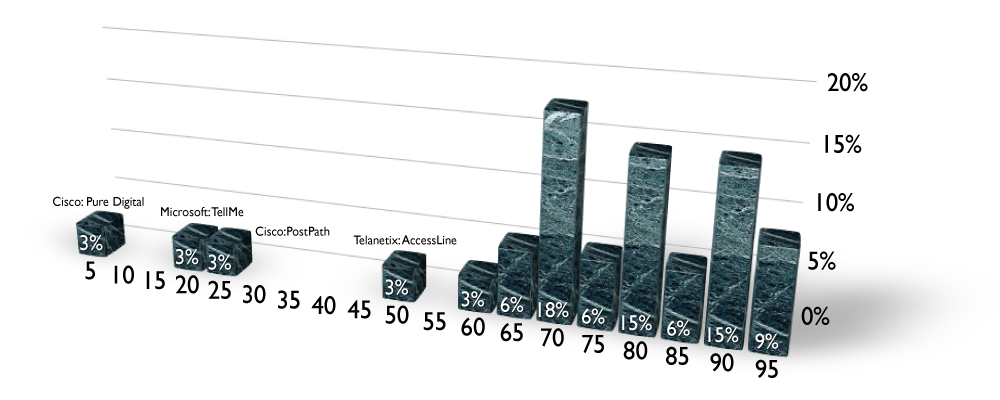

ILOG is 20 years old, has 850 employees, 3000 customers and a robust ISV and OEM partner community with over 500 OEM partners embedding ILOG technologies. Product-wise, ILOG has both a rules engine that retains the logic of business processes, a linear programming engine that given limited resources, can optimize a business process such as a scheduling system and visualization technology that presents that complex data in visual forms. The financial terms of the deal are quite impressive – 56% premium over past 30 days stock price. Deal should close in 4Q08, and is valued at $340 million.

Strategic Fit [5/5].

IBM is already a big user of ILOG technologies as part of their Global Services consulting operation. This fills a hole in IBM Software's portfolio. As is always the case in these classes of acquisitions, his deal may force competitors who are current ILOG partners (MSFT, Oracle, SAP) to find alternatives sooner than later. I doubt that ILOG can keep these ISVs (particularly Microsoft, SAP and Oracle) who see themselves competing with IBM, happy for long. ILOG competitors ought to be arranging appointments now.

Timing [4/5].

According to the press release, this deal will require approval of both EU and USA's anti-trust regulatory agencies, before the offer can be tendered in France to French shareholders of ILOG. This move broadens IBM's WebSphere portfolio's scope, but doesn't help it address new markets. Many ILOG customers are IBM customers.

Customer Demand [3/5].

Clearly, BPM without solid decision engines and without solid visualization is not going to last. Business processes need to provide metadata to process managers so they can monitor the effort properly. Visualization of that information is not only natural, but increasingly, a requirement. This raises the bar for competitors and accelerates the footprint of the ILOG technology, since visualization is after all, a feature of the business process.

Potential [4/5].

This deal is about growth. Growing the total IBM share of new customer installs, and old customer license/service renewals. The OEM renewals will require particularly solid OEM sales management to smooth over the competitive concerns.