Cisco agrees to buy TANDBERG, the Norwegian video communications equipment market leader, paying $3 billion, an 11% premium to yesterday’s Oslo market close for the stock. Expected to close in first half 2010, the deal will result in a video communications juggernaut being led by Fredrik Halvorsen, CEO of TANDBERG.

A lot of analysis in the coming months will carp about the product overlaps, but will likely miss the strategic jewel at the heart of this acquisition – channel. You can quite reasonably have alternative channels for alternative products, and I suspect that that’s exactly what Cisco will do. TANDBERG product for TANDBERG channel (indirect) and Cisco product for Cisco channel (direct).

Strategic Fit [5/5] – Complementary Channels.

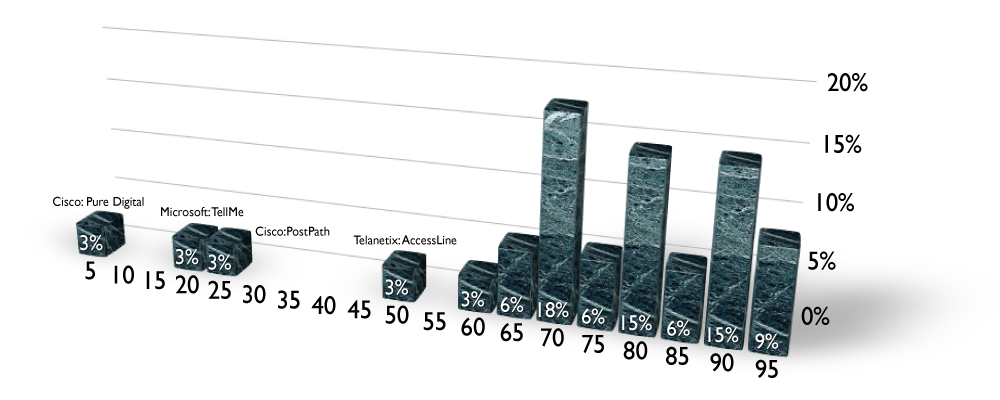

Cisco’s acquisition of TANDBERG solves several major issues for Cisco, few of which were product related. Historically, Cisco’s acquisitions were of small companies with great technologies and no distribution network. Acquisition meant adding a zero (10x more) or two (100x more) to revenues for these deals. But, as Cisco got bigger, so did the deals, where in fact it is no longer about the technology and all about the distribution network. Webex. Scientific-Atlanta. TANDBERG. These deals were about customers and new channels that would have cost billions and taken years to develop otherwise.

Since introduction in 2006, Cisco sold its brand of telepresence equipment through Cisco direct sales teams focused on the largest accounts in the world. Their penetration of this market is limited to the coverage and productivity of a direct sales person, which can only be justified on accounts purchasing say $5 or $6 million/year of Cisco-branded equipment. Given that most equipment have several years of useful life, that’s a big account probably employing thousands of employees.

TANDBERG, on the other hand, has a completely indirect sales channel that sells through a network of well-established and trusted AV (Audio-Visual) specialists. This global network is the heart of the Cisco deal. Now, Cisco hopes to engage these resellers to carry more, sell more and bring the new Cisco-brand of ‘TelePresence’ to the medium enterprise market, a new growth space that neither company had been able to address to date.

Timing [5/5] – Recessions are Better Time to Buy.

Recessions are extraordinary times for the strong to get stronger, and John Chambers knows it. Now I understand why SilverLake wanted to buy TANDBERG: so they could sell it to Cisco.

Customer Demand [3/5].

Enterprise customers generally have tremendous respect for Cisco products (they work) and Cisco support (it works fast). Video communications have generally been purchased from one or another brand. Polycom customers typically consider themselves Polycom customers and TANDBERG customers consider themselves TANDBERG customers. Growth in the past have been through technology upgrades such as SD to HD, low engineered video rooms to tightly controlled experience of telepresence suites, and expansion in terms of the number of locations and rooms in those locations that can be addressed.

TANDBERG customers have not been worried about the company’s viability despite rumors of PE interest in the firm and this deal will only strengthen their confidence in the operation of the company.

A common tactic has been to split the business between vendors, or at least have two vendors bid against each other for an expansion or replacement project. By reducing the number of credible telepresence vendors, there will be more of this tactic involving Polycom, where the practice had been to make Cisco and TANDBERG compete.

Potential [1/5].