![]() Well, despite the last minute nail-biting, it’s official. Avaya won the auction for Nortel Enterprise with a $900 million bid. What a cliff-hanger. The IRS sued for $3 billion in back taxes (this can’t be a credible lawsuit can it?), and a few days before the final auction date, Verizon sued that its contracts with Nortel were too important to national security to allow the winning bidder to reject them. Could you make this stuff up? This sure sounds like a 200x version of “Dallas” coming your way. Plenty of fodder for clever Canadian writers. I expect a TV-movie in about two years depending on whether there’s any more gnashing of teeth in this continuing saga that is the once mighty, the once proud Nortel…

Well, despite the last minute nail-biting, it’s official. Avaya won the auction for Nortel Enterprise with a $900 million bid. What a cliff-hanger. The IRS sued for $3 billion in back taxes (this can’t be a credible lawsuit can it?), and a few days before the final auction date, Verizon sued that its contracts with Nortel were too important to national security to allow the winning bidder to reject them. Could you make this stuff up? This sure sounds like a 200x version of “Dallas” coming your way. Plenty of fodder for clever Canadian writers. I expect a TV-movie in about two years depending on whether there’s any more gnashing of teeth in this continuing saga that is the once mighty, the once proud Nortel…

Here’s the Brockmann analysis of this deal.

Strategic Fit [5/5] – Complementary Channels.

Acquiring weaker competitors is a natural business response to recession since prices for companies are depressed, and executives in market leading firms need to grow, including grow through acquisition if necessary. Nortel Enterprise does offer products with overlapping capabilities (see the Acquisition Analysis report), but the channels are very complementary. Avaya sells mostly direct, while Nortel sells almost exclusively in-direct through phone company and various telecom resellers. That’s why Avaya will not rationalize product overlaps.

Never mind the product overlap in voice platforms or contact centers, or various alliances for phones (Nortel) or LAN switching (Avaya). Nortel channels could resell the Avaya phones and Avaya channels could resell the Nortel switches. In fact a simple MOU could enable these transactions to begin without anti-trust approvals.

Timing [5/5] – Recessions are Better Time to Buy.

Recessions are extraordinary times for the strong to get stronger. Remember it was only 2 years ago that we analyzed (as a speculative piece) Nor-ya. SilverLake Partners and TPG eventually paid $8 billion. A huge over-payment, except that Avaya was eventually saddled with $8 billion in debt, a price that Nortel’s board could not compete with. Remember where the stock was at the time? Pretty low. I think all of Nortel was valued at $2 billion, so buying a $2 billion/year run rate business for 4 x didn’t make a lot of sense to Nortel shareholders, but it did make sense to SilverLake and TPG.

Customer Demand [2/5].

Enterprise customers have made big investments over time in their communications infrastructures. They don’t have to put up with degraded support or degraded technologies. Avaya needs to walk carefully and assure customers that the combined company is determined to satisfy their needs better than ever before.

Potential [1/5].

Potential for profits – yes (which will go to paying off Avaya’s debt). Potential for growth – not so much. Potential for innovation – I’ll have to wait and see.

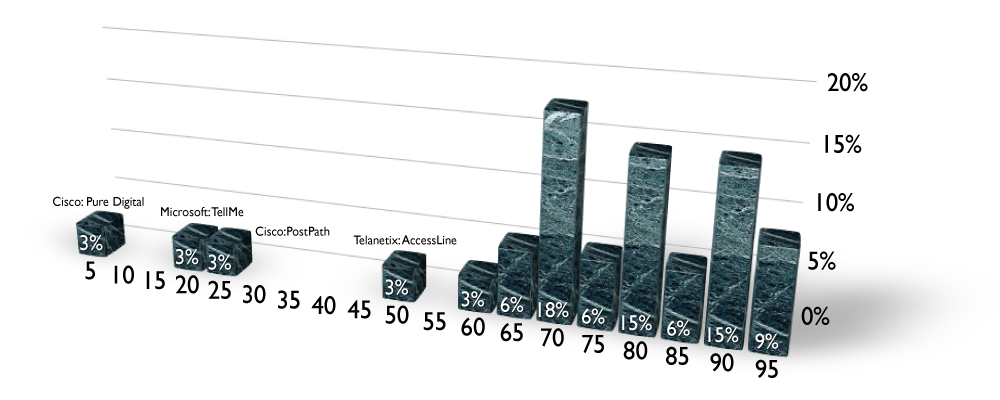

But, we now live in a new world of plentiful communications, where innovators like Microsoft, Cisco and others are acting like public utilities and government bureaucracies. Microsoft is actually losing share in smartphone OS by ignoring segments that used to get them excited. Cisco people are a little arrogant, now that they’re working on solving world hunger through committees and boards and matrix. Sadly, the stock is down and stubbornly staying down. I think John Chambers’ successor will have to revitalize the stock and the brand by selling off many of the recent big acquisitions. They certainly grew, but not through innovation. That’s why that company is stuck in the mud.

The only question now, who’s buying who next?