It was just after Labor Day 2007 when Telanetix announced their acquisition of Access Line, a hosted VoIP service provider focusing on the small medium business segment.

It was just after Labor Day 2007 when Telanetix announced their acquisition of Access Line, a hosted VoIP service provider focusing on the small medium business segment.

I have written about Telanetix before so hearing about the transaction really surprised me. Not that they had acquired a company, but that they had acquired a VoIP services company.

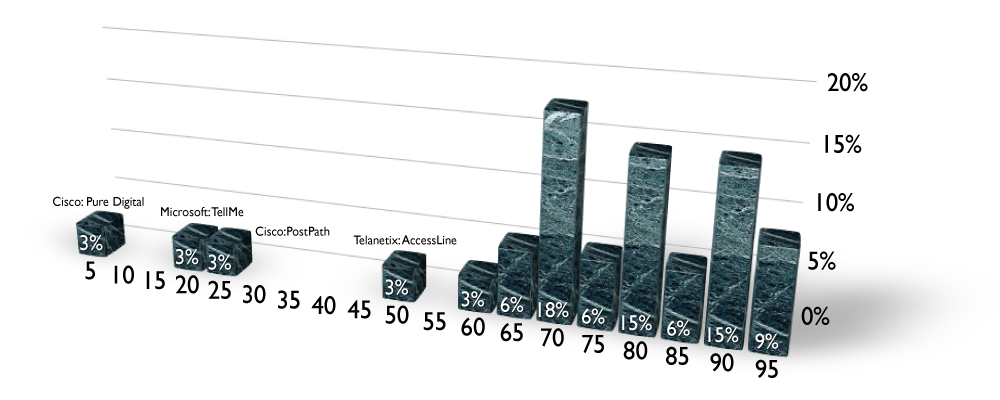

Key terms of the deal include $26 million in cash and stock with a $9 million earnout on achievement of certain milestones over 24 months. Access Line has 100,000 subscribers and a $2 million/month run rate business. The two companies share the goal of addressing the 200-500 employee market in the USA.

Brockmann rating on this deal is as follows:

Strategic fit [3/5]. Telanetix aims at the cost-sensitive medium business segment here in the USA. This segment is beyond the economic reach of the Teliris, Cisco and HP channels. Teliris, Cisco and HP have direct sales aiming at the CxO's of the largest corporations. These competitors do not have the channel in place to economically capture opportunities in these segments (yet). This deal is about relationships with customers in this segment. Telanetix plans to optimize the inside sales organization to upsell telepresence services to Access Line's VoIP dialtone customers.

This is a risky venture that may pay off anyways. With a well understood service model, and home grown technology, both companies have operational procedures in sales, marketing and support that are proven to be scalable. But, just because a customer needs dialtone doesn't mean they'll need telepresence service. So it's not just about 100,000 subscribers, it's about 50 companies of 500 employees each with multiple sites (the rest are smaller, single site organizations). In fact, I bet there's even a degree of industry sensitivity at play here (legal and healthcare for example). Of those 50 companies, how many will it take to create a synergy that may not have been addressable by Telanetix before the deal?

Timing [2/5]. This move is about capturing opportunity before the high end gets saturated and those players start moving down-market. It's time, but not for a deal outside their main purview of telepresence services. Sure Telanetix had to do something to accelerate growth, but why an independent VoIP service providers when that market hasn't matured or begun consolidation?

Customer demand [3/5]. The MidMarket is almost always under served, but in this rarified space, the value has to be industry-aligned. Horizontal or geographically limited plays don't deliver the sustainable advantage.

Potential [2/5]. It's too early to diversify the telepresence market. Instead, I would have expected a video service consolidation from Telanetix and a VoIP service consolidation from Access Line.

Overall: 10/20 = 50%.