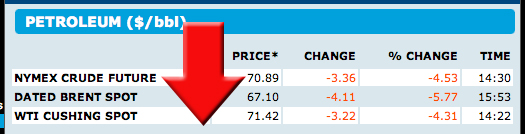

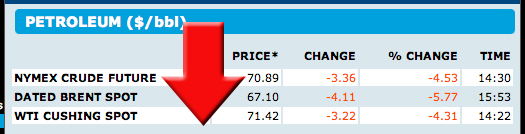

The price of energy has been falling these past few weeks recently forcing OPEC to announce production cuts to balance supply with lowered demand and shore up prices for oil. Oil was in the $150/bbl range as recently as July.

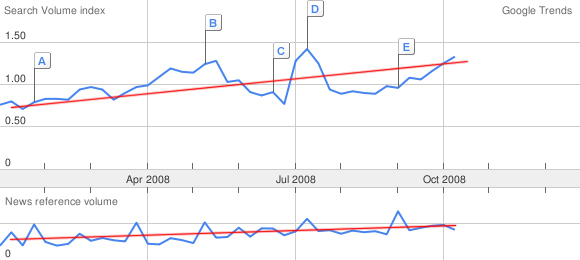

Tom Wright of the Wall Street Journal reports that the prospects of renewable energy companies are declining with the price of oil. Although wind energy has been a topic of considerable interest over 2008, according to the Google Trends shown the frequency of searches and news reference volume on 'wind energy' in 2008 below, access to capital may have compound issues in financing the development.

Tom explains that some companies are shelving their IPO plans, others are issuing more shares and American energy companies are consolidating to gain access to the capital depth of state-owned utilities and private equity firms with cash. It seems that big European leaders in the nascient market will use their scale and access to cash as a way to acquire assets from their more heavily leveraged US competitors.

Tom explains that some companies are shelving their IPO plans, others are issuing more shares and American energy companies are consolidating to gain access to the capital depth of state-owned utilities and private equity firms with cash. It seems that big European leaders in the nascient market will use their scale and access to cash as a way to acquire assets from their more heavily leveraged US competitors.

It is logical that the high price of oil drives interest and access to cash for renewable energy sources. It is also logical that a market downturn is used by many companies to stimulate their market acquisition processes so as to acquire the scale, resources, leadership and customers on the cheap, relative to acquiring at the top of the market cycle.