Brockmann has been a participant in nearly $10 billion of mergers and acquisitions as a business development executive, expert witness before the European Commission and the US Department of Justice and ‘spin doctor’. His core contributions to the Nortel – Bay Networks deal ($6.1 billion, 1998) was at various stages of the project:

- He was the first to methodically analyze the Bay product portfolio estimating size, market share and percent growth for each category. These powerpoints became the basis for educating any new deal participants about what Bay offered.

- He calculated the ‘walk away price.’ In studying why M&A fail, he learned that the top reason was because the acquirer paid too much. To avoid that in this project, Brockmann estimated which of the others’ products could be sold (and how much) by one sales organization to their customers, and then by the other organization to their products. Presumably, the walk away price could not justify more than the net present value of these incremental sales.

- He prepared and polished the presentations used to convince the board of directors that this was a good idea.

- He was the lead business person on the anti-trust review of the deal by the Canadian department of Commerce, the European Commission’s Merger Task Force and the US Department of Justice. Here the Canadians wanted a short essay completed and after submission sent back a letter saying they did not object to the transaction, but reserved the right to review the deal within the next three years.

The Europeans wanted an essay, comparing each possible product category combinations, for Europe, North America and Rest of World.

The US Department of Justice followed the Hart Scott Rodino Act (HSR) which required all documents used to discuss the deal with officers and directors to be provided for review. A single, clarifying meeting was organized to answer their specific deal questions and understand more about the various product categories and market boundaries.

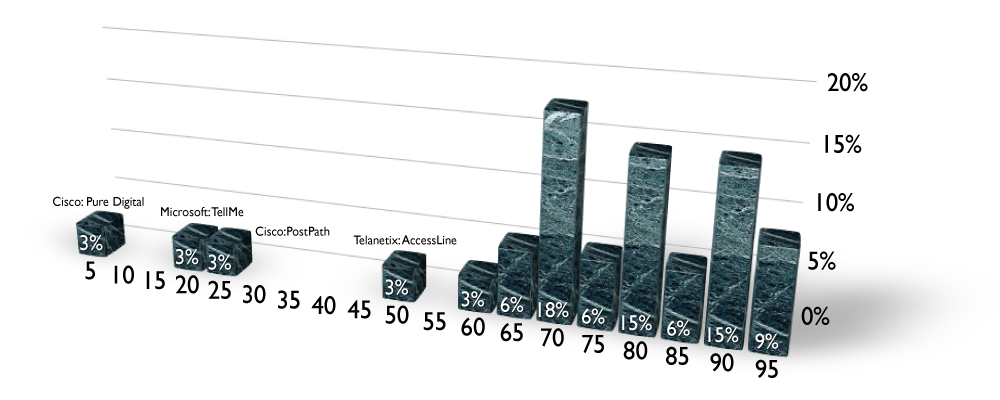

The Deal Report Card is a third party assessments of M&As in enterprirse communications technologies and markets.