Vancouver's CounterPath, fresh from it's acquisition of NewHeights in August 2007 has further accelerated its position in client software for VoIP systems by acquiring FirstHand Technologies (a former employer of mine). The deal is expected to close today (February 1, 2008) and is valued at $9.3 million. The investors in FirstHand will end up receiving about 23% of the outstanding shares of the publicly traded CounterPath (OTCBB: COPA).

About CounterPath:

Probably still better known as X-Ten, the company was founded in 2003, leading provider of client software for SIP-oriented services. The NewHeights deal brought several key relationships among customers – Sylantro and Bell Canada – and made [[Terry Matthews]], CounterPath's chairman and single largest owner of the company.

Brockmann rating on this deal is as follows:

Strategic fit [5/5]. CounterPath, as the original manufacturer of the X-Ten product is a software company that both OEM's its products to service providers and equipment providers and sells off the web. Here the two companies have a solid and non-overlapping fit. In fact, the FirstHand product line and customers brings the enterprise marketplace front and center to CounterPath which had been focused on service providers. The FirstHand portfolio is mobility-centric. The FirstHand customers/channels are enterprise-centric. These two dimensions are terrific assets that CounterPath could not get anywhere else.

Timing [3/5]. Coming on the heels of the Nokia – Trolltech announcement, the potential breakup of Motorola and the ongoing consolidation of the software universe (Microsoft-Yahoo!), this deal is not inordinately out of context. The only question is where does CounterPath go from here?

The answer to that can only mean more rollup action in complementary spaces. Maybe IP phones? An open source PBX company?

Customer demand [4/5]. CounterPath sales people now have some opportunities to sell something special (mobility) to the VoIP service providers they already have. Enterprise OEMers (Nortel, NEC, 3Com) already have SIP clients so won't really be interested in CounterPath's other products. Perhaps the greatest opportunity is to sell the FirstHand offer through the online sales platform and model of the X-Ten. This may be the vehicle to accelerate the move forward on.

Potential [2/5]. The VoIP client market is a tough market. Low barriers to entry as seen in tough competitors from Russia (SJLabs) coupled with the slow to recoup revenue models ($/seat) and ease with which vendors can readily assemble available components to build your own makes it a tough market to build a presence in. Relationships are key, but only if you can position your next innovation or get to a decent revenue level to make it worthwhile. I don't see CounterPath in a position to amass a billion dollar business here, or even a $100 million business.

This dampens the comparatives that Agito , Divitas , OnRelay and Tango might actually have hoped for. Total invested in FirstHand was $16.5 million ($3.5A, $6B, $7C rounds). After the Cisco-Orative and Avaya-Traverse deals, it seems there is room for more investor disappointments.

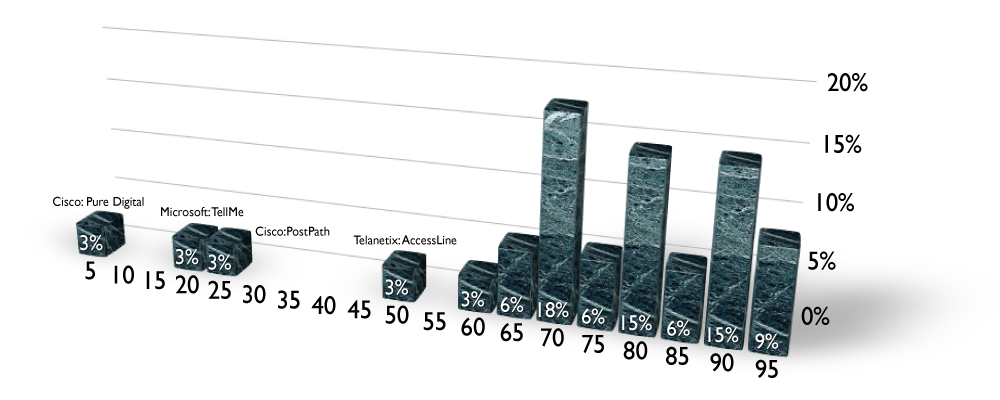

Overall: 14/20 = 70%.