![]() Earlier this week, Nortel announced and Avaya announced that the Nortel Enterprise unit would be sold to Avaya for $475 million, roughly $0.50 per dollar of revenue.

Earlier this week, Nortel announced and Avaya announced that the Nortel Enterprise unit would be sold to Avaya for $475 million, roughly $0.50 per dollar of revenue.

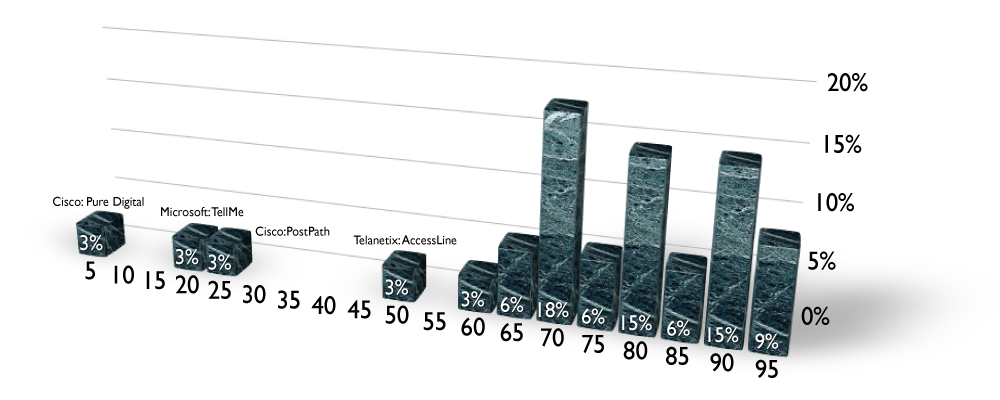

Of course, this generated a storm of analyst comments, most of which applauded the idea of industry consolidation and many of whom thanked the gods for an end to the Nortel saga. I’ve written about IPT consolidation in the past (Nor-vaya, Now is the Time, Siemens, Astraa Ericsson, Mitel-Intertel), but argue for it for very different reasons than my friend Zeus Karravela (note that Avaya acquiring Ubiquity was about accessing the carrier market not about market consolidation since Ubiquity had zero enterprise customers).

Don’t forget this is a STALKING HORSE BID. It defines only the floor price of the auction to come.

What’s particularly important to consider and most analysts are missing, is that this is a stalking-horse bid. Stalking horse bids are often used in bankruptcy proceedings to set a reasonable floor in the upcoming auction for the company. Under the supervision of the bankruptcy court, the company to be sold picks whom they would like to make an offer and make a bid they do. The offer is widely publicized, which neutralizes any low bids and then the auction proceeds. The stalking horse bidder can choose to match/beat the highest bid at their convenience, and there’s no bid lower than the stalking horse bid. So, although this deal and the Nokia Siemens Networks bid for Nortel wireless assets were pretty low, they are only the floor of the prices the various bidders are contemplating.

The Nortel Enterprise auction, supervised by the bankruptcy court (in Canada I believe) will be held in September 2009.