Tandberg, the Norwegian video conferencing equipment competitor to Polycom announced September 6, 2007 that it has acquired the UK-based Codian for stock and cash valued at $270 million.

Tandberg, the Norwegian video conferencing equipment competitor to Polycom announced September 6, 2007 that it has acquired the UK-based Codian for stock and cash valued at $270 million.

This deal follows the market changing 'decapitating' move into the resource-rich and lucrative Telepresence market by HP and Cisco.

HP and Cisco have limited product sets (although Cisco does OEM one of the Tandberg desktop video systems and the Radvision portfolio) but quite uniquely, they have DIRECT SALES with regular access to the CEO-levels of their respective customers, something neither Tandberg or Polycom have. The goal of Cisco and HP is to carve out their foothold through CEO-level sales in deals that don't involve the video professionals in the enterprise. As the system in a customer expands to meet the sure-to-be-huge demand for that TPE – Tele-Presence-Experience – Cisco and HP hope to followup with gateway solutions like the one announced last week.

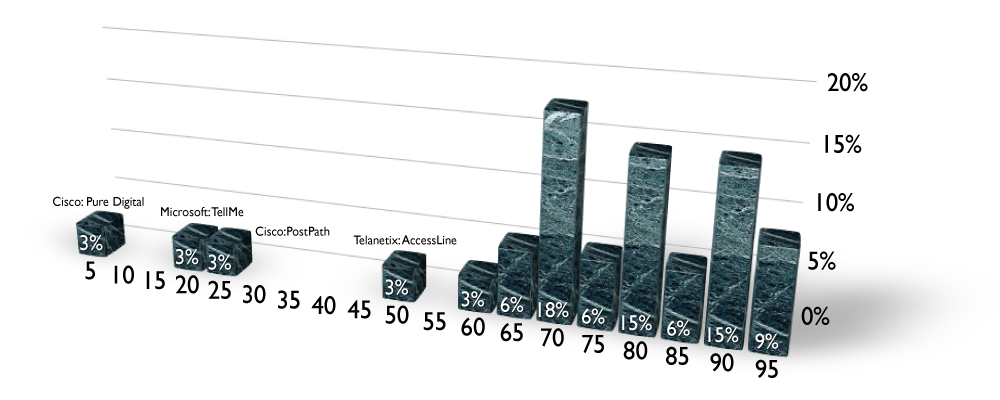

Brockmann rating on this deal is as follows:

Strategic fit [5/5]. Codian's MCU products for high performance bridging are very well respected and fill the ultra-high performance niche that Tandberg had previously missed. Codian has a direct sales channel to address the needs of the service provider and large enterprise market, to further complement the Tandberg products and channels and close the gap with HP and Cisco in some segments. One of these segments is the video service provider where Codian sits at the junction of Telepresence and HD systems with powerful systems enabling effective interworking. Video service providers understand the needs of this market and can present a powerful case for enterprise hosting and telepresence 'peering' per IPVGateways.

Timing [5/5]. This move is important to reasserting Tandberg's portfolio leadership in the nascent telepresence market. It will give the channel confidence and much needed 'testosterone' to win against the formidable skills of Cisco and HP. Brockmann & Company has writen about the market dynamics and user preferences in The Perfect Storm and Telepresence: Seeing is Believing.

Customer demand [4/5]. Telepresence users need to connect with more users than just the folks in another like-branded suite. This portfolio expansion puts Tandberg at the junction of legacy and new implementations with a critical technology necessary for bringing sites together in more than a point-to-point setting. Every enterprise serious about telepresence needs access to MCU facilities (owned or rented) to assure a sufficiently high value network.

Potential [4/5]. Brockmann & Company estimates that this deal will accelerate Tandberg's growth as well as give Codian sales a big boost. Codian had sales of $13 million so far this year and is probably on a trajectory to hit $20 million by year end. At $2.5 million/employee, this deal points to the powerful intellectual property advantage achieved and proven by customer acceptance in this young company founded only in 2002. Note that Codian is suing Polycom for patent infringement in Texarkana.

Overall: 18/20 = 90%.