BCE , the venerable Canadian telecommunications and now telecom, mobility & media conglomerate sold itself earlier this week to the Ontario Teachers Pension Fund for $48.5 billion cash. The deal includes $16 billion in debt, preferred equity and minority interests.

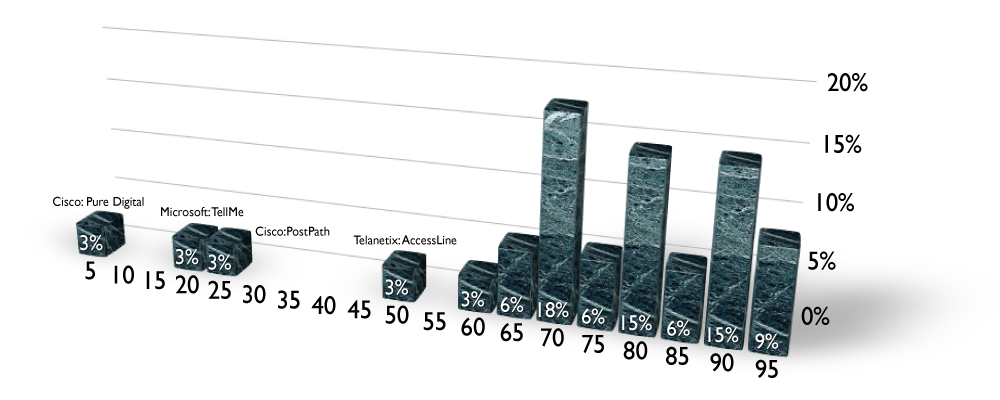

This is a 42% premium over the BCE stock price of March 28, when it became known that the company was in the process of conducting an auction. Earlier last week, Telus, the western Canada telco and CDMA wireless competitor throughout Canada, declined further participation in the deal. Surely, they participated early in the process to ensure that prices were sky-high for the competitors and to get in the dealflow. Surely top executives knew that the anti-trust regulator in Canada would likely require a bust-up for overlapping units, particularly the wireless units, which would depress their 'walk-away' price. The Seaboard Group has publicly noted that Canadians pay 50% more for wireless service than Americans. Competition needs to be a little stronger, one would think…

Telus and Bell Canada share wireline responsibilities in Alberta and BC for Telus and Ontario, Quebec and Atlantic Canada through the Aliant unit meaning Nova Scotia, Newfoundland, PEI and New Brunswick. BCE and Telus compete in wireless services. BCE also owns an interest in CTVGlobeMedia, the CTV television network and the Globe and Mail newspaper.

At one time, BCE owned Trans-Canada Pipeline long enough to deploy fiber strands inside the pipeline right-of-way across western Canada, BCE owned a sizeable chunk of Nortel as well as myriad other properties including Telsat, Excel Communications here in the USA and Memotec.

Analysis

Ontario Teachers Pension Fund is buying this company for its earnings power. The stock has been flat for some time, despite competitive gains by Rogers and Telus. Pensions need to mix safe investments and growth and BCE was more the latter. At the same time, telecommunications service providers are limited to majority Canadian ownership by federal statute and given the organization's footprint (consistently among the most profitable companies in Canada), it represents a sizeable component of the Toronto Stock Exchange, it made sense to own the whole enchilada especially since the stock did not and is not likely to appreciate. This way the fund can control the dividends a little better.

In the announcement, it is clear that there is no plans to change directions, drive greater cost out of the business or otherwise restructure the operations into greater growth markets. BCE's already there. It's just that their regulated footprint is so vast, and the Canadian market so limited, that it really has been a struggle to grow the stock.

Overall

Phone companies are utility services. They manage monopoly services and have been regulated to earn profits in the past, pretty much keeping all the gains from technological improvements. In the past decades, the development of competitive services – wireless, broadband and the like – have kept pricing pressure on the basic service and enabled new investments in technologies and networks while maintaining the social goal of ubiquitous access to the network.

I have argued before that it is silly for phone companies to 'not like being bit pushers.' This is like the elephant that doesn't like being big. It's the nature of the beast and anything more is a denial of the basic laws of consumers. You can extend the brand only so far, and then there is less synergy created as a result of being part of the mothership. Microsoft, Intel, Nortel, and GM are four excellent brands that are in the process of learning that awful truth.

This is where the telecom service business is headed. Utility dividends. Utility marketing. Utility service. Is that really such a bad thing?