Over the weekend, Google announced the acquisition of DoubleClick for $3.1 billion. DoubleClick is the banner advertising network with $300 million in revenue. The company had been bid up by Yahoo! and Microsoft. Interesting to me that the Wall Street Journal reported that AT&T and Microsoft are complaining to the anti-trust authorities about this deal.

From my experience (while at Nortel, we complained about the Lucent acquisition of Ascend) it is a fruitless task in the US. Of course the regulator will take the call, and listen to the argument (it is afterall what they do), but it will be unsuccessful – especially coming from the two monopolists in their markets. Is the kettle calling the pot black?

That's because the Hart-Scott-Rodino Act tells the regulators to look more at Google and DoubleClick documentation on the deal (documentation meaning memos, presentation and analysis shared with officers and directors of the company). It's actually a brilliant piece of legislation as compared to the Canadian and European models of special reports/essays that can be influenced by competitors.

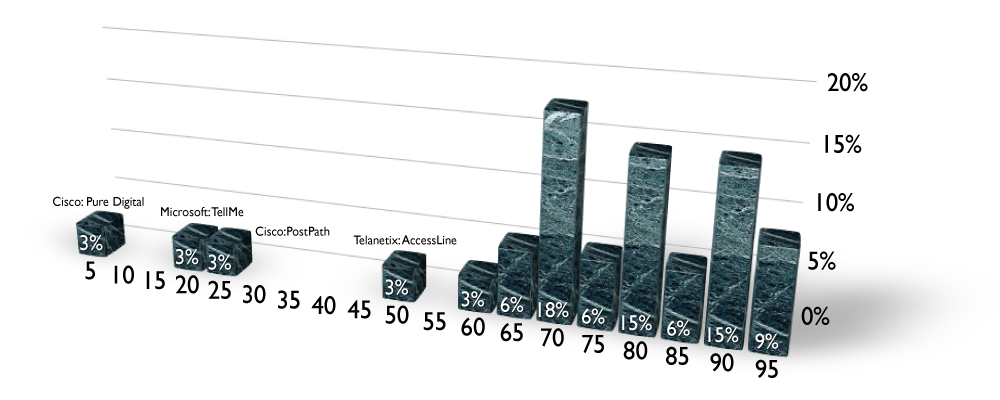

Here's my scoring of the deal:

Strategic fit [5/5].

Google sees itself as an advertising network & media company. DoubleClick is a display advertising network, an area that Google can complement with its video advertising capabilities, its radio advertising network and its base text advertising capabilities. This deal is also strategic because it keeps its competitors weak. Product synergy, competitive strength make this a 5.

Timing [3/5].

Were it not for the fact that the other guys were contemplating the acquisition, it might not have been the best time for Google's activation of this deal at this time. DoubleClick has a mature (as far as online businesses go) revenue model. It is well established as the leader in the display space.

Customer demand [2/5].

It's the web. Advertisers can get to any site or network with a click or a 10-digit call. No doubt, there may be credit advantages and maybe some price advantages for large advertisers in being able to aggregate purchasing across the video-text-display-radio network. Perhaps Google will deliver some shared technology that make aggregation management possible and practical? Frankly, I don't think this is likely for some time. Customers and the agencies that manage the media buys really don't care where they make their display media buys from, just so long as it delivers the results.

Potential [4/5].

Sure there's big potential here. It's advertising media, something that Google is actually pretty good at. This deal has excellent upside on both sides – Google can offer the DoubleClick model to its Adwords clients and DoubleClick can present the mother of all properties to its advertisers – Google.com and its network. At the same time Google can introduce DoubleClick to its enormous network of small business advertisers.

Letter grade = B (70%).