On Friday, November 10, 2006, Motorola announced that Good Technology was acquired for an undisclosed sum. Good’s technology imitated Blackberry email functionality for non-Blackberry devices, including Motorola-branded devices.

Since most of Good’s market footprint is in non-MOT devices, surely the company will continue to develop its applications for non-MOT devices. According to Friday’s press release posted on good.com, MOT does plan to continue the multi-device strategy.

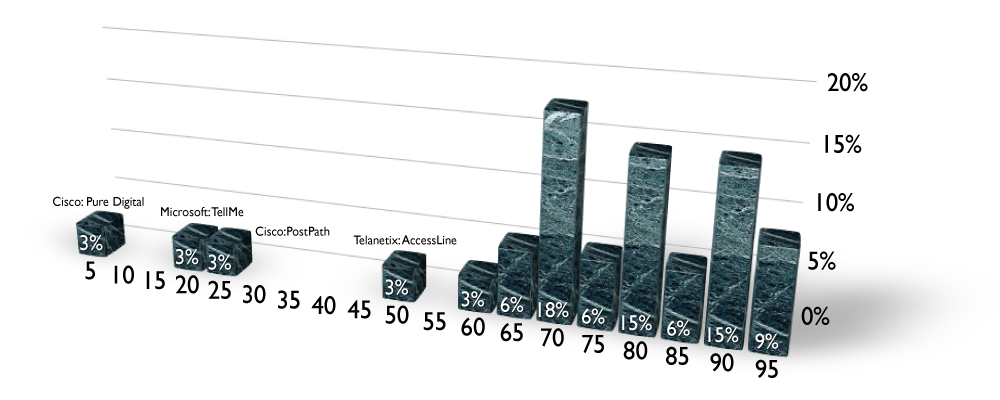

— Here’s the Deal Score: —

Strategic fit [4/5]. RIM set the tone for mobile data security and mobile email. Nokia followed with the acquisition of Intellisync; and now RIM. The mobile devices market needs a value added mobile security revenue stream to complement their devices for enterprise applications. With this deal, Motorola joins a rarified club with Nokia, RIM and Microsoft. If you can’t beat ’em, join ’em.

Timing [2/5]. There were few choices for Motorola, and even fewer for Good. This was an obvious deal, but one that took way too long to come about. Motorola should have realized this market dynamic as it began development (or even before) of what became the Q, their first smartphone, introduced in the fall of 2006.

Customer demand [3/5]. Enterprise customers prefer flexibility and choices. The opportunity for Motorola to include its own security server and email service model gives Good users the staying power of a market leader like Motorola. At the same time, this deal may in fact help Motorola position its devices into accounts that might not have considered Motorola devices, but had chosen Good software.

Potential [4/5]. Mobility and enterprise is growing like a rocket. This race is by no means satisfied. Motorola needed the capability, and so do the customers.

Total Score: 15/20 = 75% B grade.