In previous blog posts, we have shown how economic recoveries are a great time to be buying up competitors to strengthen the firm’s competitiveness once the recovery begins.

Q. But what should a company do if they’re already too big to buy up meaningful competitors or if competitors are bigger, and they are generating tons of cash from existing operations?

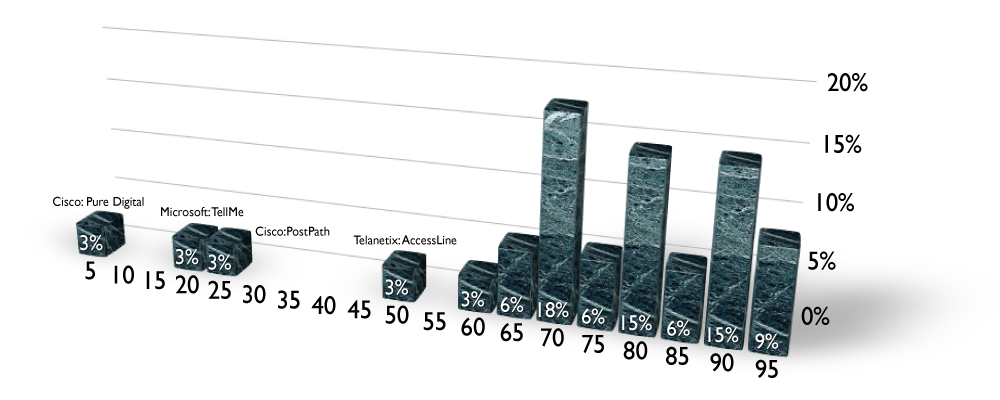

A. Share buybacks, and they’re on the rise. Here’s a simple table explaining the mechanics involved.

| Feature | Before Buyback | After BuyBack | Comment |

| Earnings | $250M | $250M | Results is results. |

| Shares Outstanding | 250M | 200M | |

| Earnings per share | $1.00 | $1.25 | |

| Price per share | $20 | $20 | Paid $1B to buy 50M shares. |

| P/E Ratio | 20 | 16 | Undervalued after buyback. |

Share buybacks have a tendency to apply upwards pressure on stock prices, since they adjust the P/E ratios out of kilter with industry peers and previous performance. An economic recovery like the one we’re experiencing with trailing investor confidence, is a natural use for the cash since it signals management’s confidence with the operation indicating that the company is a worthy investment of cash.

It’s particularly useful once your cash balance goals are achieved and while opportunities are in the process of being identified. Otherwise earning another 0.5% interest while keeping it on deposit somewhere is not particularly exciting to shareholders.