HP Picks up Palm

![]()

HP announced a definitive all-cash agreement to acquire Palm for $1.2 billion. The iconic smartphone developer had been languishing lately despite well-respected products, lacking the caché and sizzle associated with more interesting products from Apple and Google (who may be hurting in its own right) and with stronger carriers than Sprint.

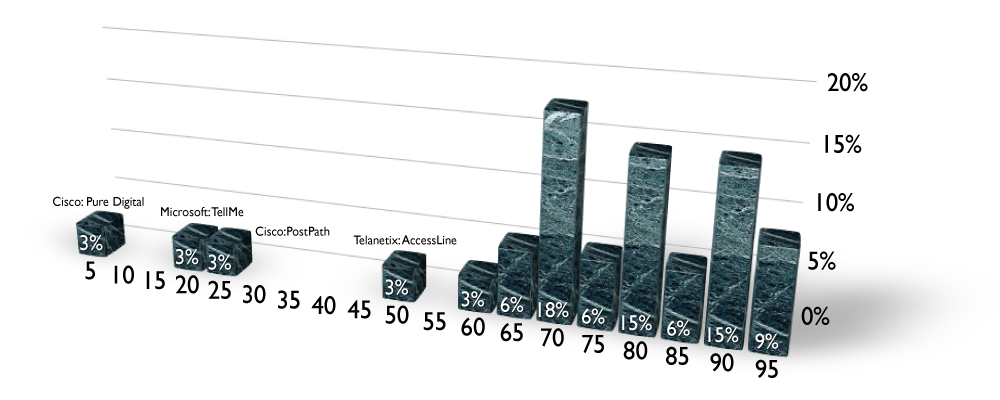

The combined market share for both HP and Palm would remain less than 5%, but at the very least gives HP a platform to build on, where it controls both the devices AND the software. This is another nail in the coffin for Microsoft Windows Mobile 7, which has been losing share and device manufacturer support.

A risky deal for HP, since product lifecycles in mobile devices are so short cycles and the RIM-Apple juggernaut has yet to see signs of creating openings for others – including Google’s Android or NexusOne.

Here’s the Brockmann scoring on the deal:

Strategic Fit: 5/5

HP has been a player in the Windows PDA market for at least a decade. As the largest PC manufacturer, the company needs to innovate with products for the hottest new product categories including touch screen devices, netbooks, readers and now, smartphones. Controlling both the hardware and software will be a first for HP, which I expect will port the Palm software onto an iPad equivalent in short order. Waiting for Windows has been just too painful and not really totally aligned with HP footprint, skills and aspirations.

We should expect other breakouts from the PC maker in this ‘end-of-the-recovery’ timeframe.

Timing: 5/5

Palm is failing, but not dead. HP paid a premium for the company on its current stock price, but not as much as they would have paid a year ago. So, there’s still the opportunity to breathe life into the product, the eco-system and the technology. HP knows how to do all of these things, especially in the end-game of a major recession. Fortunately too, John Rubinstein, the CEO of Palm will stay with HP.

Customer Demand: 3/5

This is the riskiest part of the deal. Hopefully, Palm’s technology can be exploded into HP’s retail channels and HP’s innovators and innovations can be exploded into Palm’s carrier channels. Probably most exciting, is to bring the Palm to the China market, where HP has leading network equipment market share (through it’s recent acquisition of 3Com), has a respectable presence in computers and servers and the iPhone has only recently been introduced. HP could easily sell 10 x as many Palms in China as Palm has sold in the USA (at lower prices and margins), but they have to do it fast and with a complete Chinese-oriented product. The window is among CDMA service providers.

Potential: 4/5

Although I’d like to think that this is about leap-frogging Apple, I don’t think HP sees it that way. It’s about catching up and filling the niches that the market leaders (Apple and RIM) can’t fill fast enough. HP has the operational muscle and diverse channel coverage to generate substantial return from this transaction.

Nice deal, score=85%.