Over my career, North America has been considered as the hotbed of innovation in communications, hardware and software. Although that's been generally true in high technology markets, its not the case in things mobile. The consensus among analysts and pundits and marketers in the business is that mobile capabilities have developed more rapidly in Europe and Asia than in the US and Canada. In these areas Europe is probably at least two years ahead of the US. The reasons for this are because the common radio/infrastructure standard in Europe (GSM) allowed mobile operators to focus their advantages on things that mattered to subscribers – coverage, quality, features and price. In North America, the barriers to switching service providers are higher and naturally means new phones (Verizon and Sprint use CDMA while AT&T and T-Mobile use GSM), quality and coverage differences that may or may not be better than their previous supplier.

One of the examples of European mobile innovation is OnRelay. Founded in 2000, OnRelay pioneered the Fixed-Mobile Convergence for business space and today have developed an impressive array of customers and capabilities for mobile UC. Originally, the company developed the MBX as an adjunct server to the PBX with mobile phone client software to control the user experience and signal to the server server software. They worked to integrate their proprietary protocol with leading PBX vendors' capabilities for common telephony features. This package, now named Managed MBX, relies on industry standard SIP or CTI interfaces to communicate with the PBX and deliver those features over the mobile network to the target users' mobile phone.

One of the examples of European mobile innovation is OnRelay. Founded in 2000, OnRelay pioneered the Fixed-Mobile Convergence for business space and today have developed an impressive array of customers and capabilities for mobile UC. Originally, the company developed the MBX as an adjunct server to the PBX with mobile phone client software to control the user experience and signal to the server server software. They worked to integrate their proprietary protocol with leading PBX vendors' capabilities for common telephony features. This package, now named Managed MBX, relies on industry standard SIP or CTI interfaces to communicate with the PBX and deliver those features over the mobile network to the target users' mobile phone.

More recently, the company announced the Unified MBX which includes an integrated open source IP PBX as part of the sale. This more comprehensive solution simplifies the customer implementation and replaces some of the functionality of typical PBX installations to more aggressively compete against other mobile UC vendors, and the name-brand PBX vendors who have developed their own mobile UC capabilities.

In a briefing last week with Jane Johnston, the OnRelay Marketing Manager, I learned about the capabilities of the solution and captured a stronger view of where OnRelay sees the opportunities in mobile UC. The client is supported through an over-the-air download procedure on Nokia E-series, N-series devices and Windows Mobile 6 platforms. OnRelay recently announced plans to support BlackBerry by YE2009.

Mobile UC starts with operations mode

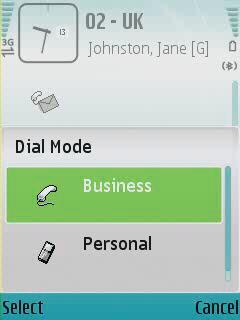

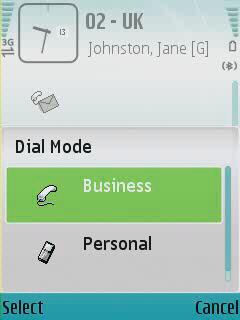

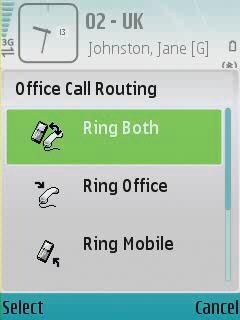

In markets such as Europe where there are more mobile phones than people, business users have one phone for work, and one phone for personal use. This is the case because in these markets caller pays and businesses negotiate lower per-minute rates with mobile operators when they commit the company's users to that mobile operator. With an MBX implementation, the user can select the mode of operation from the client UI, allowing a convergence of devices. With this simple selection, office dialing can be enabled so parties called from the Business mode are presented with the enterprise caller ID, while parties called from the Personal mode are presented with the mobile phone's caller ID, thereby protecting the mobile users' mobile privacy when on business. This service also initiates calls from the enterprise premises to the mobile phone and the called party binding the session control in the enterprise PBX. This enables an integrated call detail record showing called parties, duration and time-date stamps for deskphone, softphone or mobile originated calls. The enterprise aggregation of called minutes (since outside the USA and Canada the caller pays) strengthens negotiations with the enterprise-centric mobile operator, and reduces the exhorbitant charges associated with roaming services.

In markets such as Europe where there are more mobile phones than people, business users have one phone for work, and one phone for personal use. This is the case because in these markets caller pays and businesses negotiate lower per-minute rates with mobile operators when they commit the company's users to that mobile operator. With an MBX implementation, the user can select the mode of operation from the client UI, allowing a convergence of devices. With this simple selection, office dialing can be enabled so parties called from the Business mode are presented with the enterprise caller ID, while parties called from the Personal mode are presented with the mobile phone's caller ID, thereby protecting the mobile users' mobile privacy when on business. This service also initiates calls from the enterprise premises to the mobile phone and the called party binding the session control in the enterprise PBX. This enables an integrated call detail record showing called parties, duration and time-date stamps for deskphone, softphone or mobile originated calls. The enterprise aggregation of called minutes (since outside the USA and Canada the caller pays) strengthens negotiations with the enterprise-centric mobile operator, and reduces the exhorbitant charges associated with roaming services.

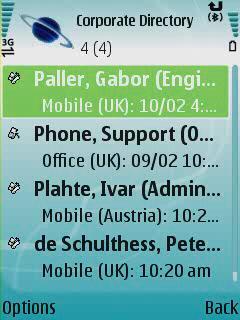

The most useful feature for mobile workers has been the corporate directory. That's because mobile users appreciate the ability to see all the employees of the company (hopefully with some sensitivity to the small screen and limited bandwidth available to the mobile user) in a way that can help them find the right person with the answer the question they need to address while away from the office. This could be a question posed by a customer about an order, a technical issue identified by the supplier or a feature availability question posed by a potential customer. In every case, the answer could be inside the head of the accounting department, the sales engineer or the product manager. The directory gives flexibility and control to the mobile worker and accelerates their ability to do business. When combined with the presence indication of listings in the directory, the mobile worker is further informed in ways that reduces voicemail and other inappropriate delays in getting answers.

In designing the standalone enterprise mobile-PBX integration that is positioned as the Unified MBX, the company did a bakeoff with Microsoft OCS 2007, Asterisk and sipXecs. In choosing sipXecs, the engineering team particularly valued the scalability and ease of use aspects as compared to the other servers. This suggests to me that OnRelay expects to market the solution more aggressively in large enterprise environments and as a service offering of enterprise-focused mobile operators where scalability is a requirement, and where an Asterisk-based offering may not be as competitive or as differentiated.

A Perspective on service provider-based mobile UC

As the feature sets and architectures are homogenized across this emerging market, it will be the channels to market that are the defining contributor to success for mobile UC solutions providers. In the case of OnRelay, the focus on mobile operators as channels is not only logical but critical in the heavily-hosted markets of Europe and Asia. In these markets, enterprises have tended to appreciate the mobile operator's operational ethic while in North America the grand-daddy of all hosted services, Centrex, has been regularly maligned for the past three decades. Together with its IP-equivalent service category, Centrex and hosted telephony has never really earned more than 10% of the enterprise market. Enterprises are generally wary of the loss of flexibility, security and control when services are hosted, prefering instead to take on the technical and operational challenges of premises solutions.

To further compound the complexity of North American market access, the mobile operators here are not organized or interested in addressing the needs and opportunities of enterprises. Their leadership are totally focused on increasing subscribers and ARPU. Today, they don't see how an enterprise offer can be all that attractive or relevant to them, which will likely change once the US market achieves the European rates of saturation, forcing them to look for defendable and profitable segments to address. In the meantime, enterprises in North America will be purchasing premises-based solutions to address their mobile enterprise needs.